FGN BOND VS LAND BONDING BY Dennis Isong | Prestige Real Estate News

Meaning of FGN Bond

An FGN (Federal Government of Nigeria) Bond is a debt security issued by the Nigerian government to raise funds from the public. These bonds are considered low-risk investments as they are backed by the government’s credit. Investors purchase FGN Bonds with the expectation of receiving periodic interest payments (coupons) and the return of the principal amount (face value) at maturity. The bonds are usually long-term, with maturities ranging from a few years to several decades.

Example of FGN Bond

Consider an investor who purchases a 10-year FGN Bond with a face value of ₦1,000,000 at an annual interest rate of 12%. The government agrees to pay the investor 12% of ₦1,000,000 each year, which amounts to ₦120,000 annually. At the end of the 10-year period, the investor will receive the initial ₦1,000,000 principal back. This setup provides a steady income stream and the safety of the principal investment.

Meaning of Land Banking

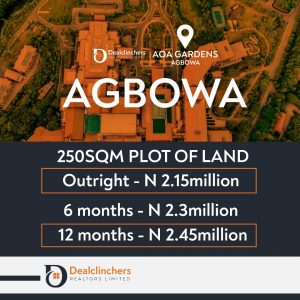

Land banking is the practice of acquiring large parcels of undeveloped land with the intention of holding onto them until they appreciate in value. This strategy is commonly used in real estate to take advantage of future urban expansion or infrastructure development. Investors in land banking typically do not develop the land immediately but wait for the right moment when the value has significantly increased, allowing for substantial profits from its sale or development.

Example of Land Banking

An investor buys 50 hectares of undeveloped land on the outskirts of Abuja, anticipating that the area will see significant urban development in the next decade. Over time, as the city’s population grows and infrastructure projects, such as roads and schools, are established in the vicinity, the land’s value increases. After 10 years, the investor sells the land at a much higher price, yielding a significant return on investment.

How FGN Bond and Land Banking Correlate

FGN Bonds and land banking, though different in nature, can complement each other in an investment portfolio. FGN Bonds provide a stable, low-risk investment with regular income, which can be used to fund more speculative ventures like land banking. Conversely, profits from land banking can be reinvested into FGN Bonds to balance an investor’s risk profile. The correlation lies in the diversification of investments, where the stability of bonds mitigates the risks associated with land banking, and the high returns from land banking enhance overall portfolio growth.

The Essence of FGN Bond in Land Banking to Real Estate

FGN Bonds play a crucial role in supporting land banking activities within the real estate sector. The predictable income from FGN Bonds can finance the purchase and maintenance of land. For real estate developers, bonds offer a source of low-risk capital that can be tapped into for long-term projects. This stability allows investors to patiently wait for land value appreciation without the pressure of high-risk investments.

Furthermore, FGN Bonds can serve as a financial cushion during economic downturns, providing real estate investors with liquidity and security. The integration of FGN Bonds into land banking strategies ensures a balanced approach to investment, promoting sustainable growth in the real estate market.

Benefits of Investing in FGN Bonds

Investing in FGN Bonds offers several advantages, particularly for those seeking stability and regular income. Key benefits include:

Low Risk: Backed by the Nigerian government, FGN Bonds are considered one of

the safest investment options available in the country.

Regular Income: Investors receive fixed interest payments semi-annually, providing

a predictable income stream.

Capital Preservation: The principal amount is returned at maturity, ensuring that

the initial investment is preserved.

Tax Incentives: Interest earned on FGN Bonds is tax-exempt, making them more

attractive compared to other taxable investments.

Liquidity: FGN Bonds can be traded on the Nigerian Stock Exchange, allowing

investors to sell their bonds before maturity if needed.

Benefits of Land Banking

Land banking also comes with its own set of advantages, particularly for those looking for high returns over the long term. Benefits include:

High Return Potential: As undeveloped land appreciates in value, significant profits

can be realized upon sale.

Diversification: Adding land to an investment portfolio diversifies risk and can

enhance overall returns.

Inflation Hedge: Real estate, including land, typically appreciates in value at a rate that outpaces inflation, protecting the purchasing power of the investment.

Strategic Advantage: Early acquisition of land in developing areas provides a strategic advantage as infrastructure and urbanization progress.

Risks Associated with FGN Bonds and Land Banking

While both investment options offer substantial benefits, they also come with inherent risks:

FGN Bonds

- Interest Rate Risk: If market interest rates rise, the value of existing bonds with lower rates may decrease.

- Inflation Risk: The fixed interest payments may not keep pace with inflation, reducing the real value of returns over time.

Land Banking

- Market Risk: The value of land can be highly volatile and influenced by economic,

political, and social factors.

- Liquidity Risk: Selling land can take time, and the market may not always be favorable, making it less liquid than other assets.

- Development Risk: Changes in zoning laws or delays in infrastructure development can impact the land’s value and the expected timeline for appreciation.

Dennis Isong is a TOP REALTOR IN LAGOS.He Helps Nigerians in

Diaspora to Own Property In Lagos Nigeria STRESS-FREE. For

Questions WhatsApp/Call 2348164741041