Top 7 must-know tips for first-time home buyers in Nigeria | Prestige Real Estate News

By Imoh Bright

Buying your first home is a thrilling adventure and one of life’s most significant milestones. It’s an exciting journey filled with anticipation, hope, and a fair share of challenges which can also feel like stepping into a maze with no clear way out.

Navigating the real estate market in Nigeria can be daunting for first-time buyers, but with the right preparation and knowledge, you can avoid common pitfalls and make a smart investment.

For many Nigerians, the excitement of finally owning a place to call your own comes with a whirlwind of questions and decisions that can quickly become overwhelming. Where do you start? How do you avoid overpaying or ending up in a money pit?

Whether you’re dreaming of a cosy condo in the city or a family-friendly house in the suburbs, these seven essential tips will guide you through the process, helping you make smart choices and secure the home of your dreams with confidence.

Here are the top 7 must-know tips to help you on your path to homeownership:

Understand your budget and get pre-approved

Before you start browsing listings, it’s crucial to have a clear understanding of your budget. This includes assessing your current income, savings, debts, and monthly expenses. Calculate how much you can comfortably afford to spend on a mortgage each month without sacrificing other financial goals or lifestyle needs.

Once you have a budget in mind, get pre-approved for a mortgage. A pre-approval not only gives you a clear idea of how much you can borrow but also shows sellers that you’re a serious buyer. It can make a difference in a competitive market where multiple offers are common.

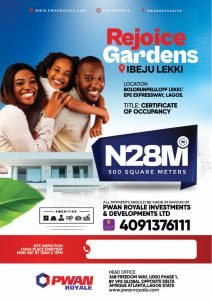

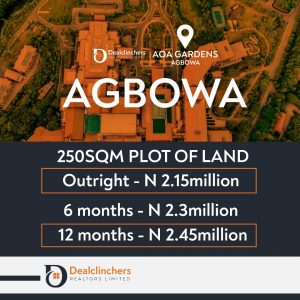

Research and choose the right location

Location is one of the most important factors in home buying. It affects everything from the home’s value to your quality of life. Spend time researching neighbourhoods that align with your priorities, such as proximity to work, schools, public transport, amenities, and safety.

Consider future developments in the area, as these can impact property values over time. Visit potential neighbourhoods at different times of the day to get a sense of traffic, noise levels, and overall ambience.

Work with a trusted real estate agent

A good real estate agent is an invaluable asset for first-time home buyers. They can provide market insights, negotiate on your behalf, and help you navigate the complex paperwork involved in buying a home. Look for an agent who is experienced, knowledgeable about the local market, and has a good track record with first-time buyers.

Don’t be afraid to interview several agents to find the right fit. Remember, a buyer’s agent works for you as their job is to find you the best home within your budget and guide you through the buying process.

Know what to look for during home viewings

When viewing potential homes, it’s easy to get swept up by aesthetics and overlook critical details. Look beyond the surface; examine the condition of the roof, windows, plumbing, electrical systems, and foundation. Pay attention to any signs of damage, such as cracks, water stains, or mold.

Take note of the home’s age, the quality of its appliances, and any recent renovations. A home inspection, typically conducted after you’ve made an offer, will reveal any major issues, but it’s helpful to be observant from the start to avoid unpleasant surprises later.

Be aware of additional costs

The cost of buying a home extends beyond the purchase price. Be prepared for additional expenses like closing costs, property taxes, homeowner’s insurance, maintenance, and utilities. Some areas may also require homeowner association (HOA) fees.

Make sure to budget for these costs when determining how much home you can afford. It’s also a good idea to set aside an emergency fund for unexpected repairs or expenses that may arise after you move in.

Don’t rush the decision-making process

Buying a home is a long-term commitment and should never be rushed. Take your time to weigh all the options and think about what matters most to you. It’s important to feel confident about your decision, not pressured.

Consider making a pros and cons list for each home you’re seriously considering. Consult with your real estate agent, friends, and family, and do not hesitate to walk away if something doesn’t feel right.

Understand the importance of a home inspection

A thorough home inspection is a must before finalising any purchase. An inspector will assess the property for any hidden issues that could lead to costly repairs in the future. Common problems uncovered during inspections include structural issues, plumbing leaks, electrical problems, and mold.

If the inspection reveals significant issues, you can negotiate repairs or a reduction in the purchase price with the seller. Always opt for a professional inspector with a good reputation to ensure that no critical details are overlooked.

- Culled from Businessday